Circular Economy Tech: 3 Innovations Minimizing Waste in US Industries by 2025

Three pivotal circular economy technologies are rapidly reshaping US industries by 2025, delivering practical solutions for waste minimization and substantial financial returns through sustainable innovation and resource efficiency.

The landscape of US industries is undergoing a significant transformation, driven by the urgent need for sustainability and efficiency. This shift is particularly evident in the rapid adoption of Circular Economy Tech: 3 Innovations Minimizing Waste in US Industries by 2025 (PRACTICAL SOLUTIONS, FINANCIAL IMPACT), promising not only environmental benefits but also substantial financial gains for businesses across the nation.

The Rise of Circular Economy Principles in US Industry

US industries are increasingly embracing the circular economy model, moving away from traditional linear ‘take-make-dispose’ approaches. This paradigm shift focuses on designing out waste and pollution, keeping products and materials in use, and regenerating natural systems. The economic imperative is clear: reducing waste means lower raw material costs, increased resource efficiency, and new revenue streams from recycled or repurposed products.

Recent reports from the Environmental Protection Agency (EPA) indicate a growing trend in corporate sustainability commitments, with many major manufacturers setting ambitious zero-waste targets. This movement is not just about compliance; it’s about competitive advantage. Companies that integrate circular economy principles often see improved brand perception, enhanced supply chain resilience, and significant cost savings over the long term. The emphasis on innovation means new technologies are constantly emerging to support these goals.

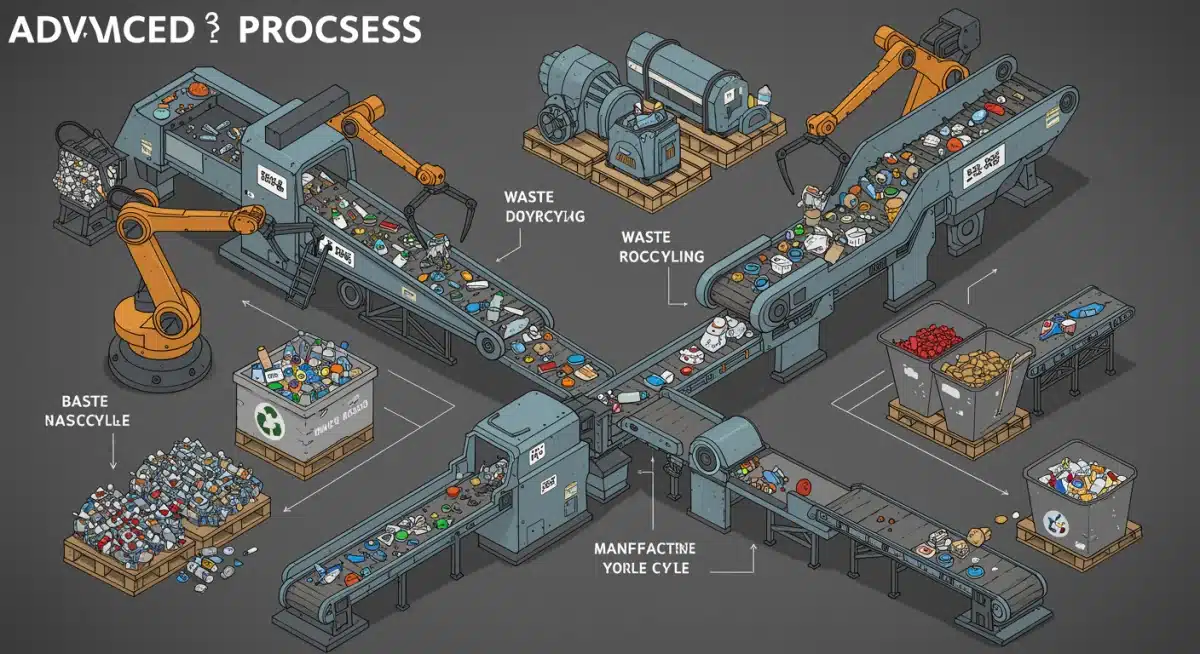

Innovation 1: Advanced Recycling Technologies

Advanced recycling technologies represent a cornerstone of the circular economy, offering solutions beyond traditional mechanical recycling. These innovations are crucial for processing complex waste streams that previously ended up in landfills or incinerators. By 2025, their widespread adoption is expected to dramatically increase material recovery rates across various sectors.

One prominent example is chemical recycling, which breaks down plastics into their basic molecular components. This allows for the creation of virgin-quality plastics, endlessly loopable without degradation. This technology addresses the limitations of mechanical recycling, particularly for mixed or contaminated plastics, unlocking significant value from waste materials. The financial impact for industries is substantial, as they can source raw materials from waste streams, reducing reliance on virgin fossil fuels and mitigating price volatility.

Chemical Recycling: A Game Changer

Chemical recycling offers a powerful solution for hard-to-recycle plastics. This method transforms plastic waste into feedstocks for new plastic production, effectively closing the loop for materials like multi-layered packaging and films.

- Pyrolysis: Converts plastic waste into oils and gases, which can then be refined into new chemical products.

- Solvolysis: Uses solvents to break down polymers into monomers, ideal for specific plastic types like PET.

- Gasification: Transforms carbon-containing materials into syngas, a versatile building block for chemicals and fuels.

These processes not only reduce landfill waste but also create a more resilient supply chain for manufacturers, providing a steady source of recycled content. As of late 2023, several major chemical companies have announced significant investments in new chemical recycling plants across the US, with many expected to be operational by 2025, according to industry analyses.

Innovation 2: Industrial Symbiosis and Waste-to-Value Platforms

Industrial symbiosis involves companies collaborating to exchange waste and by-products, turning one industry’s waste into another’s raw material. This approach fosters regional circular economies, minimizing overall waste generation and optimizing resource use. Digital waste-to-value platforms are facilitating these connections, making it easier for businesses to identify and trade waste streams.

These platforms leverage data analytics and AI to match waste producers with potential users, creating efficient marketplaces for secondary materials. For instance, a food processing plant’s organic waste could become feedstock for an anaerobic digester, producing biogas and nutrient-rich fertilizer. This not only reduces disposal costs but also generates new revenue streams and enhances local economic ecosystems. The financial impact includes reduced waste management expenses, lower raw material procurement costs, and potential income from selling by-products.

Connecting Industries for Resource Efficiency

Waste-to-value platforms are emerging as critical tools for actualizing industrial symbiosis. They provide the infrastructure for businesses to identify, quantify, and exchange resources that would otherwise be discarded.

- Material Exchange Marketplaces: Online platforms connecting companies with surplus materials or waste streams to those who can use them.

- Data-Driven Matching: Utilizing AI and machine learning to efficiently match diverse waste types with suitable industrial processes.

- Logistics Optimization: Integrating logistics solutions to streamline the transportation of secondary materials between facilities.

The growth of these platforms is supported by government initiatives and private sector investment, aiming to build robust regional circular economies. A recent report by the Department of Commerce highlighted several successful industrial symbiosis hubs emerging in states like California and Michigan, demonstrating significant reductions in landfill waste and increased local economic activity.

Innovation 3: Product-as-a-Service (PaaS) Models and Longevity Design

The shift towards Product-as-a-Service (PaaS) models and the emphasis on longevity design are fundamentally changing how products are conceived, used, and managed. Instead of selling a product outright, companies offer its function or service, retaining ownership and responsibility for maintenance, repair, and end-of-life management. This incentivizes manufacturers to design durable, repairable, and upgradable products, minimizing waste and maximizing resource utilization.

This model encourages a mindset of product stewardship, where the lifespan of components and materials is extended through circular design principles. For consumers, it means access to high-quality products without the upfront cost of ownership, often with built-in maintenance and upgrade paths. For businesses, PaaS models can create stable, recurring revenue streams and foster deeper customer relationships. The financial impact includes reduced material consumption, lower production costs over the long term, and increased customer lifetime value.

Designing for Durability and Service

PaaS models require a fundamental rethinking of product design, prioritizing durability, modularity, and ease of repair. This ensures products remain in use for as long as possible, reducing the need for new raw materials.

- Modular Design: Products are designed with interchangeable components, making repairs and upgrades simpler and more cost-effective.

- Repairability Focus: Manufacturers provide accessible spare parts, repair guides, and authorized service networks to extend product life.

- Material Selection: Emphasis on durable, recyclable, and non-toxic materials to facilitate multiple use cycles.

Companies like Interface (flooring) and Philips (lighting) have successfully implemented PaaS models, demonstrating significant environmental benefits and robust financial performance. The trend is expanding rapidly into electronics, apparel, and industrial equipment, with many manufacturers exploring subscription-based services and extended warranty programs as of early 2024.

Policy and Investment Driving Circular Economy Adoption

The acceleration of circular economy tech in US industries is not solely driven by corporate innovation; supportive policies and strategic investments play a crucial role. Federal and state governments are increasingly implementing initiatives to encourage sustainable practices, including grants for research and development, tax incentives for companies adopting circular models, and regulations promoting extended producer responsibility (EPR).

Private investment firms and venture capitalists are also channeling significant capital into circular economy startups and established companies that demonstrate strong sustainability credentials. This influx of funding is enabling rapid scaling of new technologies and fostering a vibrant ecosystem of innovation. The alignment of policy, investment, and corporate strategy is creating a powerful tailwind for the circular transition, signaling a long-term commitment to waste minimization and resource efficiency across the US economy.

For example, the recent Bipartisan Infrastructure Law includes provisions that indirectly support circular economy initiatives, such as funding for recycling infrastructure and sustainable manufacturing research. This governmental backing provides a stable foundation for industries to invest with confidence in these transformative technologies, expecting a favorable regulatory and economic environment in the coming years.

Measuring Impact and Future Outlook for US Industries

As these circular economy technologies gain traction, measuring their impact becomes paramount. Industries are increasingly adopting metrics beyond traditional financial indicators, incorporating environmental and social performance. Key performance indicators (KPIs) now include waste diversion rates, recycled content percentages, carbon footprint reductions, and resource efficiency gains. These metrics provide a holistic view of the benefits derived from circular practices.

The outlook for US industries by 2025 is one of accelerated transformation. The widespread adoption of advanced recycling, industrial symbiosis, and PaaS models is expected to significantly reduce industrial waste, lower operational costs, and create new economic opportunities. This shift is not just about compliance but about building resilient, competitive, and sustainable businesses that thrive in a resource-constrained world. The integration of digital technologies, such as AI and blockchain, will further enhance the efficiency and transparency of circular supply chains, solidifying the circular economy’s role as a core driver of future industrial growth.

| Key Innovation | Brief Description |

|---|---|

| Advanced Recycling | Technologies like chemical recycling break down complex waste into raw materials for new products, enhancing material recovery. |

| Industrial Symbiosis Platforms | Digital platforms connect industries to exchange waste as resources, reducing disposal costs and creating new revenue streams. |

| Product-as-a-Service (PaaS) | Manufacturers retain ownership, offering product functions. This incentivizes durable, repairable designs and recurring revenue. |

| Policy & Investment | Government incentives and private funding are accelerating the adoption and scaling of circular economy solutions. |

Frequently Asked Questions About Circular Economy Tech

The main objective is to minimize waste and maximize resource utilization by designing products for durability, reuse, and recycling. This approach aims to reduce reliance on virgin materials, lower environmental impact, and create economic value from previously discarded resources, driving sustainability.

Advanced recycling, like chemical recycling, breaks down materials to their molecular level, allowing for the creation of virgin-quality products from complex waste streams. Traditional mechanical recycling often degrades material quality over time, limiting its applications and the number of recycling cycles.

Companies benefit from stable, recurring revenue streams, reduced material consumption, and lower production costs through extended product lifespans. PaaS models also foster stronger customer relationships and can lead to improved brand loyalty by offering comprehensive service and maintenance.

These platforms connect diverse industries, enabling them to exchange waste and by-products, turning one company’s waste into another’s valuable resource. This collaboration significantly reduces the amount of waste sent to landfills and incinerators, optimizing resource flow within regional economies.

Yes, both federal and state governments are increasingly implementing supportive policies. These include grants for R&D, tax incentives for sustainable practices, and regulations promoting extended producer responsibility (EPR), all designed to accelerate the transition to a circular economy model.

What Happens Next

The rapid integration of circular economy technologies into US industries is a dynamic and ongoing process. As 2025 approaches, observers should anticipate further advancements in material science, AI-driven resource management, and the expansion of legislative frameworks supporting circularity. The success of these innovations will heavily depend on continued collaboration between industry stakeholders, policymakers, and consumers. Expect to see more pilot programs scale nationally, driving significant reductions in industrial waste and fostering a more resilient, sustainable US economy.