Beyond Solar Panels: 5 Green Tech Investments for 2025

Beyond Solar Panels: 5 Emerging Green Tech Investments for a Sustainable 2025 (INSIDER KNOWLEDGE, FINANCIAL IMPACT) identifies key sectors like advanced battery storage, green hydrogen, sustainable agriculture tech, carbon capture, and circular economy innovations, poised for substantial growth and offering attractive returns for informed investors.

The landscape of sustainable investing is rapidly evolving. While solar panels have long been a cornerstone of green portfolios, new technologies are emerging that promise even greater impact and financial returns. For those seeking to capitalize on the next wave of eco-innovation, understanding these five emerging Green Tech Investments 2025 is crucial.

The Shifting Tides of Green Investment

The global push for decarbonization and sustainable development continues to accelerate, driving unprecedented innovation in green technology. Investors are increasingly recognizing that environmental responsibility can coincide with significant financial gains, leading to a diversification of capital beyond established renewable energy sources.

This shift is not merely about altruism; it is a strategic response to evolving market demands, regulatory pressures, and the tangible economic benefits of efficiency and resource optimization. As of early 2024, institutional investors are re-evaluating their long-term strategies, seeking out disruptive technologies that offer insulation against future climate risks and position them for leadership in a green economy.

Beyond Traditional Renewables

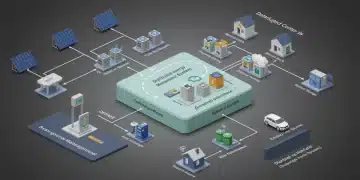

While wind and solar power remain vital, the ancillary technologies that support and enhance their deployment, alongside entirely new sectors, are now attracting substantial venture capital and private equity interest. This expanded focus reflects a maturation of the green tech market, where integrated solutions and systemic changes are gaining prominence.

- Energy storage solutions are critical for grid stability and renewable energy integration.

- Decarbonization of heavy industries presents massive market opportunities.

- Sustainable resource management addresses fundamental challenges in production and consumption.

Advanced Battery Storage Solutions

As renewable energy sources like solar and wind become more prevalent, the challenge of intermittency grows. Advanced battery storage solutions are the linchpin for a stable, resilient, and fully decarbonized electrical grid. These technologies are moving beyond lithium-ion, with significant breakthroughs on the horizon.

The market for grid-scale energy storage is projected to expand dramatically, driven by declining manufacturing costs and increasing demand from utility companies and industrial sectors. Innovations in battery chemistry and architecture are leading to safer, more efficient, and longer-lasting storage systems, making them an attractive area for Green Tech Investments 2025.

Next-Generation Battery Technologies

Researchers and startups are exploring various alternatives to traditional lithium-ion, each offering unique advantages for specific applications. These next-gen batteries promise to unlock new levels of performance and sustainability.

- Solid-State Batteries: Offering higher energy density and improved safety, solid-state technology is attracting significant investment from automotive and grid storage sectors.

- Flow Batteries: Ideal for large-scale, long-duration storage, flow batteries utilize liquid electrolytes and can be scaled independently of power, making them perfect for grid applications.

- Sodium-Ion Batteries: Utilizing abundant and inexpensive sodium, these batteries present a promising alternative to lithium, mitigating supply chain risks and reducing costs.

Green Hydrogen Production and Infrastructure

Green hydrogen, produced by electrolyzing water using renewable electricity, is emerging as a critical component for decarbonizing hard-to-abate sectors such as heavy industry, long-haul transport, and aviation. Its versatility as an energy carrier and industrial feedstock positions it as a transformative investment opportunity.

Governments worldwide are implementing policies and providing incentives to accelerate the production and adoption of green hydrogen, recognizing its strategic importance. This regulatory tailwind, combined with technological advancements in electrolyzer efficiency, is making green hydrogen a compelling target for Green Tech Investments 2025. The development of robust infrastructure for transport and storage is also a key investment area.

Key Investment Areas in Green Hydrogen

The green hydrogen ecosystem is complex, offering multiple points for investment across its value chain. From production to end-use, each segment presents unique growth prospects.

Investment is flowing into companies developing more efficient and cost-effective electrolyzers, which are central to green hydrogen production. Additionally, the infrastructure required to transport and store hydrogen—pipelines, liquefaction plants, and specialized tanks—represents a significant capital expenditure opportunity. Fuel cell technology, which converts hydrogen into electricity, is also a burgeoning market for powering vehicles and stationary applications.

Sustainable Agriculture Technology (Agri-Tech)

Feeding a growing global population sustainably is one of the 21st century’s most pressing challenges. Sustainable agriculture technology, or agri-tech, offers innovative solutions to reduce environmental impact, enhance food security, and improve agricultural productivity. This sector encompasses a wide range of technologies, from precision farming and vertical farms to biotechnology and alternative proteins.

Investors are increasingly recognizing the potential of agri-tech to deliver both environmental benefits and strong financial returns. Companies developing solutions that minimize water usage, reduce reliance on chemical fertilizers and pesticides, and optimize land use are particularly attractive. The integration of AI and IoT in farming practices is revolutionizing efficiency and resource management.

Recent developments, such as advancements in gene-editing for crop resilience and the rapid scaling of indoor farming operations, underscore the dynamic nature of this sector. These innovations are not just incremental improvements; they represent fundamental shifts in how food is produced and consumed, making agri-tech a vital area for Green Tech Investments 2025.

Innovations Driving Agri-Tech Growth

Several key technological advancements are propelling the agri-tech sector forward, creating new market opportunities and investment pathways. These innovations address various aspects of agricultural sustainability and efficiency.

- Precision Agriculture: Utilizing GPS, sensors, and data analytics to optimize crop yields and reduce resource waste.

- Vertical Farming: Cultivating crops in vertically stacked layers, often indoors, minimizing land and water use while enabling local food production.

- Biotechnology in Agriculture: Developing genetically optimized crops for disease resistance, enhanced nutrition, and climate resilience.

- Alternative Proteins: Producing plant-based or lab-grown meat and dairy alternatives to reduce the environmental footprint of traditional animal agriculture.

Carbon Capture, Utilization, and Storage (CCUS)

Even with aggressive decarbonization efforts, some industrial emissions will be difficult to eliminate entirely. Carbon Capture, Utilization, and Storage (CCUS) technologies play a crucial role in mitigating these residual emissions by capturing CO2 from industrial sources or directly from the atmosphere. This captured carbon can then be stored underground or utilized in various industrial processes.

The CCUS market is experiencing rapid growth, fueled by government incentives, corporate net-zero commitments, and technological advancements that are driving down costs. Companies specializing in direct air capture (DAC), point-source capture, and carbon conversion technologies are attracting significant investment. As of late 2023, several large-scale CCUS projects have secured substantial public and private funding, signaling strong market confidence.

The financial impact of CCUS is multifaceted, extending beyond environmental compliance to create new industries and revenue streams through carbon utilization. This sector is becoming an indispensable part of the global climate solution, making it a high-potential area for Green Tech Investments 2025.

Circular Economy Innovations

The traditional linear economy of ‘take-make-dispose’ is inherently unsustainable. Circular economy innovations aim to decouple economic growth from resource consumption by designing out waste and pollution, keeping products and materials in use, and regenerating natural systems. This holistic approach offers vast opportunities for investment across various sectors.

Investment in the circular economy extends to companies focused on advanced recycling technologies, product-as-a-service models, sustainable packaging, and industrial symbiosis. These innovations not only reduce environmental impact but also create new value chains, enhance resource security, and drive cost efficiencies for businesses. The European Union, for instance, has been a major proponent of circular economy principles, with significant policy support and funding initiatives.

As consumer demand for sustainable products grows and regulatory frameworks tighten, businesses adopting circular principles are gaining a competitive edge. This makes circular economy innovations a broad yet critically important category for Green Tech Investments 2025, offering diverse entry points for investors seeking both financial returns and positive environmental impact.

Key Pillars of Circular Economy Investment

The circular economy encompasses a broad spectrum of activities, each contributing to a more sustainable economic model. Understanding these pillars helps identify specific investment avenues.

- Advanced Recycling: Technologies that can process complex waste streams, including plastics and electronics, into high-quality secondary raw materials.

- Product-as-a-Service (PaaS): Business models where consumers pay for the use of a product rather than its ownership, incentivizing durability and repairability.

- Sustainable Packaging: Innovations in materials and design that reduce waste, increase recyclability, and minimize environmental footprint.

- Industrial Symbiosis: Collaboration among industries to share resources and by-products, turning one company’s waste into another’s raw material.

| Key Investment Area | Brief Description |

|---|---|

| Advanced Battery Storage | Next-gen batteries (solid-state, flow, sodium-ion) crucial for grid stability and EV infrastructure. |

| Green Hydrogen | Renewable-powered hydrogen for decarbonizing heavy industry and transport, with growing infrastructure needs. |

| Sustainable Agri-Tech | Innovations in precision farming, vertical farms, and alternative proteins for sustainable food production. |

| Carbon Capture (CCUS) | Technologies capturing CO2 from atmosphere or industrial sources for storage or utilization, vital for net-zero goals. |

Frequently Asked Questions About Green Tech Investments

The growth is fueled by global decarbonization mandates, increasing consumer and corporate demand for sustainable solutions, technological advancements reducing costs, and supportive government policies and incentives. These factors collectively create a robust market environment for innovation and investment.

Advanced battery solutions move beyond conventional lithium-ion, incorporating innovations like solid-state, flow, and sodium-ion technologies. These offer superior energy density, enhanced safety, longer lifespans, and utilize more abundant materials, making them more efficient and sustainable for various applications, especially grid-scale storage.

Green hydrogen is crucial for decarbonizing sectors that are difficult to electrify, such as heavy industry and long-haul transport. Its production using renewable electricity makes it a clean energy carrier with broad applications, supported by significant government and private sector investment in infrastructure and technology development.

Agri-tech addresses global food security and environmental impact by developing solutions for sustainable agriculture. Investments in precision farming, vertical farming, biotechnology, and alternative proteins aim to reduce resource consumption, improve yields, and mitigate climate change effects, offering both ecological and financial returns.

Circular economy innovations generate financial impact by reducing waste, optimizing resource use, and creating new value chains. Companies focusing on advanced recycling, product-as-a-service models, and sustainable packaging gain competitive advantages, reduce operational costs, and meet growing consumer demand for eco-friendly products, driving profitability.

Looking Ahead: The Future of Green Tech Investments

The trajectory for Green Tech Investments 2025 is set for significant expansion, far beyond the familiar territory of solar panels. The insights presented here underscore a profound shift in how capital is allocated within the sustainability sector. As these emerging technologies mature, they will not only address critical environmental challenges but also reshape global industries and create new economic powerhouses. Investors who proactively engage with these innovative areas stand to realize substantial returns, contributing to a more sustainable future while securing robust financial outcomes. The coming years will undoubtedly witness accelerated deployments and further technological breakthroughs, solidifying green tech’s role as a cornerstone of modern investment portfolios.